Probiotics see biggest ever online surge in 2020

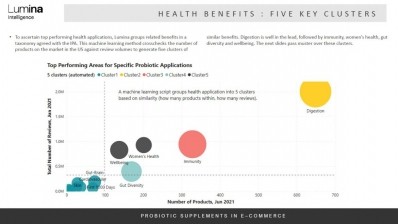

According to new data from Lumina Intelligence, there were 147,000 new online reviews for probiotics in Europe in 2020 alone (4.5 out of 5 on average) - an increase in one year which far exceeds the total number of reviews before that (total of 78,000 at the end of 2019).

Ewa Hudson, director of insights at Lumina Intelligence, tells NutraIngredients: "Seeing more reviews in 2020 than in all the years prior to it is really exciting for the market.

"And this trend is seen across the globe, not just in Europe. Clearly it has largely been driven by the increasing interest in health products driven by the pandemic and that is made particularly apparent when looking at the specific health target areas which have seen the largest growth."

Looking at target health areas with the largest product engagement growth in Europe, Lumina's data shows that weight management - a topic thrown into the limelight by COVID-19 - saw a 511% growth in reviews, with a sizeable 30 products tracked altogether.

This data comes as Optibiotix reveals it doubled sales of its prebiotic-based weight management solutions (SlimBiome ingredient and SlimBiome Medical) in 2020, versus the previous year.

Stephen O'Hara, Founder and Chief Executive at the UK based life sciences company, says heightened stress and weight gain piqued by the pandemic, paired with the growing 'wellness' trend, have increased consumer interest in the brand's natural weight management and general wellness solutions (WellBiome).

He says: "The pandemic has changed the way consumers think and feel about their health and wellbeing, particularly weight management, with the widespread knowledge that obesity influences the severity of Covid-19."

In support of this, a study conducted by Innova (Consumer Lifestyle and Attitudes Study 2020) reported that as many as one in two consumers have increased their functional food and drink supplementation in 2020 alone.

“This change in lifestyle has accelerated the search for natural solutions to support mental and physiological wellbeing...

"Science-backed weight management solutions that focus on sustainable weight loss can tap into this audience, helping provide support to those looking to reduce weight or associated health risks amongst rising obesity rates.”

O’Hara suggests it’s not just the heightened awareness of the link between obesity and COVID-19 severity that has led to a rising interest in weight management. He says weight gain is intrinsically linked to anxiety and other psychological disorders which are prevalent right now.

In fact, Friends of Europe reported in October 2020 that 80% of Italians have stated they require psychological support, more than a third of Dutch citizens said their anxiety and stress had increased, while Sweden has seen a dramatic increase in self-reported mental health problems.

He says these catalysts, along with the heightened interest in 'wellness', have led to a rising demand for weight management products which target the core issue.

"The wellness trend has certainly seen an uplift in recent years and has discovered new footing amidst consumers during the ongoing pandemic, especially in the younger generation. While we still have consumers who look at weight loss in the more traditional sense, we also have a rapidly growing subset that wants to maintain a healthy lifestyle by using wellness-first products.

"These consumers are then more likely to opt for prebiotics as they stimulate the beneficial bacteria in the gut, promoting overall health and wellness...we’ve recognised this growing trend and developed WellBiome, a functional fibre and mineral blend that supports health and wellbeing. "

Other trends

According to Lumina's data, healthy ageing is another health target with rapidly rising online engagement, with a 481% growth in 2020, and 31 products altogether, followed by vaginal health, UTI's and women's health also atop the percentage growth chart.

Men's health saw a huge growth of 91500% although this was from a tiny base, with just five products on the market in 2020.

Ewa notes that with 10% of probiotics being aimed at women's health and only 0.3% aimed at men's health, this potentially shows a gap in the market for innovators.

Products targeting halitosis also saw a large rise in engagement in 2020, with a 1007% growth, but also from a small starting point - a total of six products on the European market in 2020. The data may well suggest an increased interest in this area of health though, perhaps coinciding with the use of face masks.